BoG Targets Dollar Pricing as NIB Records GH¢74m Profit and GUTA Issues Retail Warning

- bernard boateng

- Jul 22, 2025

- 3 min read

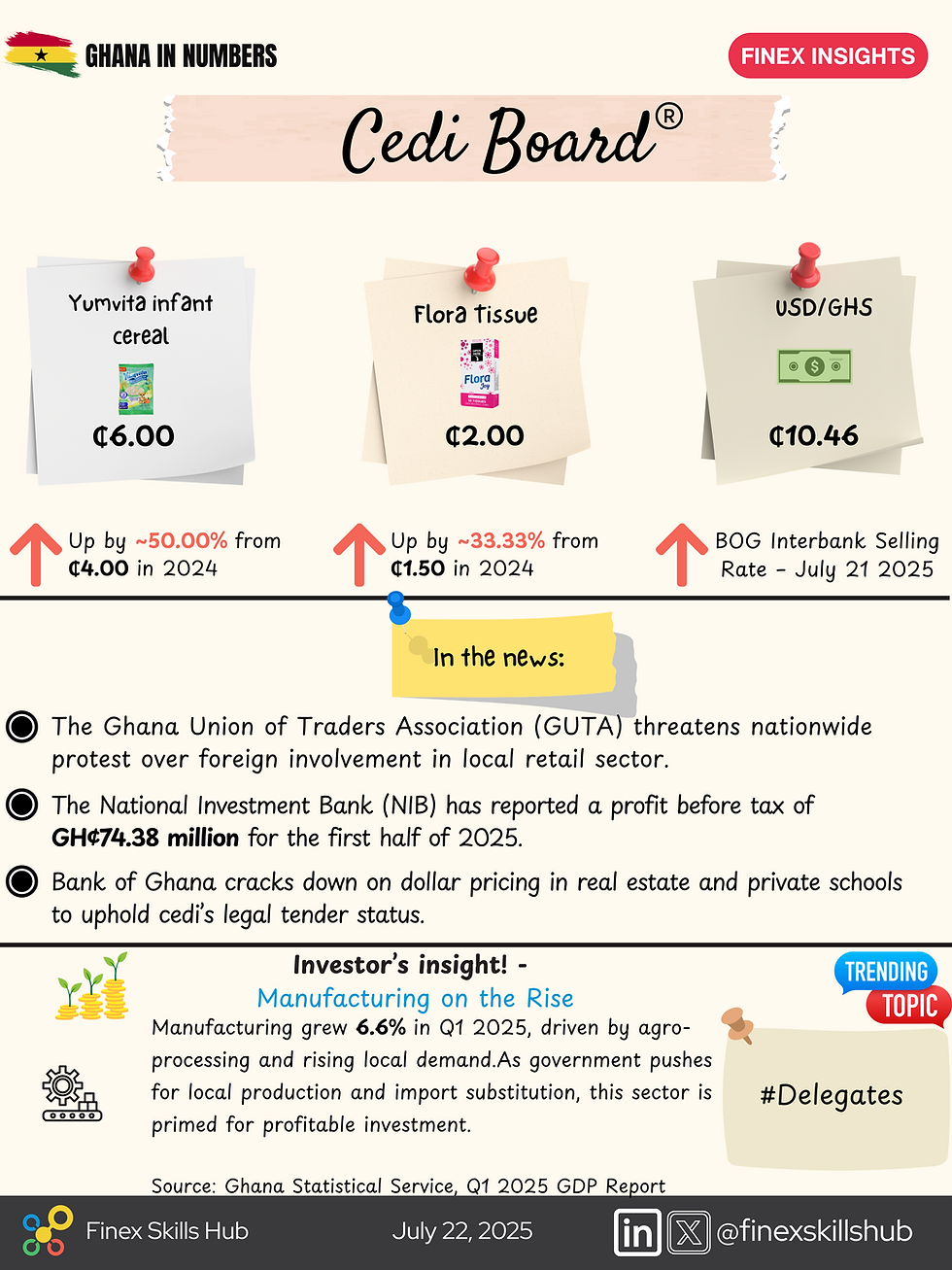

Prices are climbing, policy pressure is intensifying, and profits are finally rebounding. The July 22 edition of the Cedi Board® captures major developments shaping Ghana’s financial landscape, from the cost of Yumvita and Flora Tissue to mounting economic nationalism in the streets.

GUTA Warns of Nationwide Protest Over Foreign Retail Invasion

The Ghana Union of Traders Association (GUTA) is sounding the alarm, again. The group is threatening nationwide demonstrations if government authorities fail to act on the increasing presence of foreign nationals in Ghana’s retail space, a sector legally reserved for Ghanaians under Section 27(1) of the GIPC Act, 2013 (Act 865).

GUTA claims illegal foreign participation, especially in urban hubs like Circle, is undercutting local businesses. The group’s Greater Accra Chairman, Nana Kwabena Peprah, expressed frustration over government silence following a previous protest.

“People are agitating and the government must immediately take action or else, GUTA members will begin demonstrations on those issues,” he warned.

The organization is pushing for strict enforcement of existing retail laws to protect Ghanaian livelihoods amid concerns of deepening economic marginalization.

NIB Swings to Profit: GH¢74.38M in H1 2025

After years of losses and financial uncertainty, the National Investment Bank (NIB) has staged a remarkable turnaround.

For the first half of 2025, NIB reported a profit before tax of GH¢74.38 million, a stark reversal from its GH¢44.79 million loss during the same period in 2024. This performance is buoyed by enhanced cost controls, improved capital recovery, and a sharp focus on operational efficiency.

Key Numbers:

Assets: GH¢8.55 billion (↑ from GH¢5.71 billion)

Customer deposits: GH¢7.3 billion

Net operating income: GH¢326.28 million

Capital Adequacy Ratio (CAR): 41.34%

This is also the first time since 2016 that NIB has released its financials — a move many see as a new chapter in transparency and public trust.

BoG Declares War on Dollar Pricing in Ghana

In a strongly worded statement, Bank of Ghana Governor Dr. Johnson Asiama is cracking down on businesses that quote prices or demand payments in US dollars, especially in real estate and private schools.

The Governor warned that this dollarisation trend:

Violates national law (BoG Act 612),

Distorts monetary policy, and

Erodes trust in the cedi.

“The use of foreign currency in everyday domestic transactions is not only illegal; it signals a loss of confidence in the cedi,” he stressed.

BoG is working closely with law enforcement, the Ghana Revenue Authority, and sector regulators to ensure compliance. While no new penalties were announced, tougher enforcement is clearly on the horizon. The central bank is also promoting cedi-based digital payments and piloting the eCedi to reduce reliance on foreign currency.

Price Watch: Yumvita and Flora Tissue See Sharp Hikes

Two household staples have seen notable price increases:

Yumvita Infant Cereal:Now selling at GH¢6.00, up by 50% from GH¢4.00 in 2024.

Flora Tissue:Now GH¢2.00, up by 33.33% from GH¢1.50 last year.

These changes reflect broader cost pressures across food and personal care items, a trend consumers and retailers alike are navigating amid inflation volatility.

Investor’s Insight – Manufacturing on the Rise

Q1 2025 saw Ghana’s manufacturing sector expand by 6.6%, driven by agro-processing and strong local demand. As the government prioritizes import substitution and domestic industrialization, this segment is becoming increasingly attractive for investors seeking long-term growth and resilience.

Investor takeaway: Manufacturing is no longer just an enabler, it’s a strategy.

Exchange Rate Update

USD/GHS: GH¢10.46(BoG interbank selling rate as of July 21, 2025)

The cedi remains firm against the dollar, buoyed by strong monetary policy and improved reserves. But as the BoG reminds us, confidence and enforcement are just as critical to long-term currency stability.

Trending Topic: #Delegates

From GUTA protests to BoG enforcement to NIB’s earnings rebound, the policy conversations are shifting toward ownership, accountability, and economic independence.

Watch the “#Delegates” trend as political and trade actors position for deeper reforms.

Stay tuned to the Cedi Board® for real-time updates on Ghana’s financial pulse. From prices and policy to investment tips that help you make sense of the numbers.

Comments