First Fund Customers Demand Action, Ghana Attracts $652m Investments, GRA Struggles with Tax Debts

- bernard boateng

- Aug 26, 2025

- 3 min read

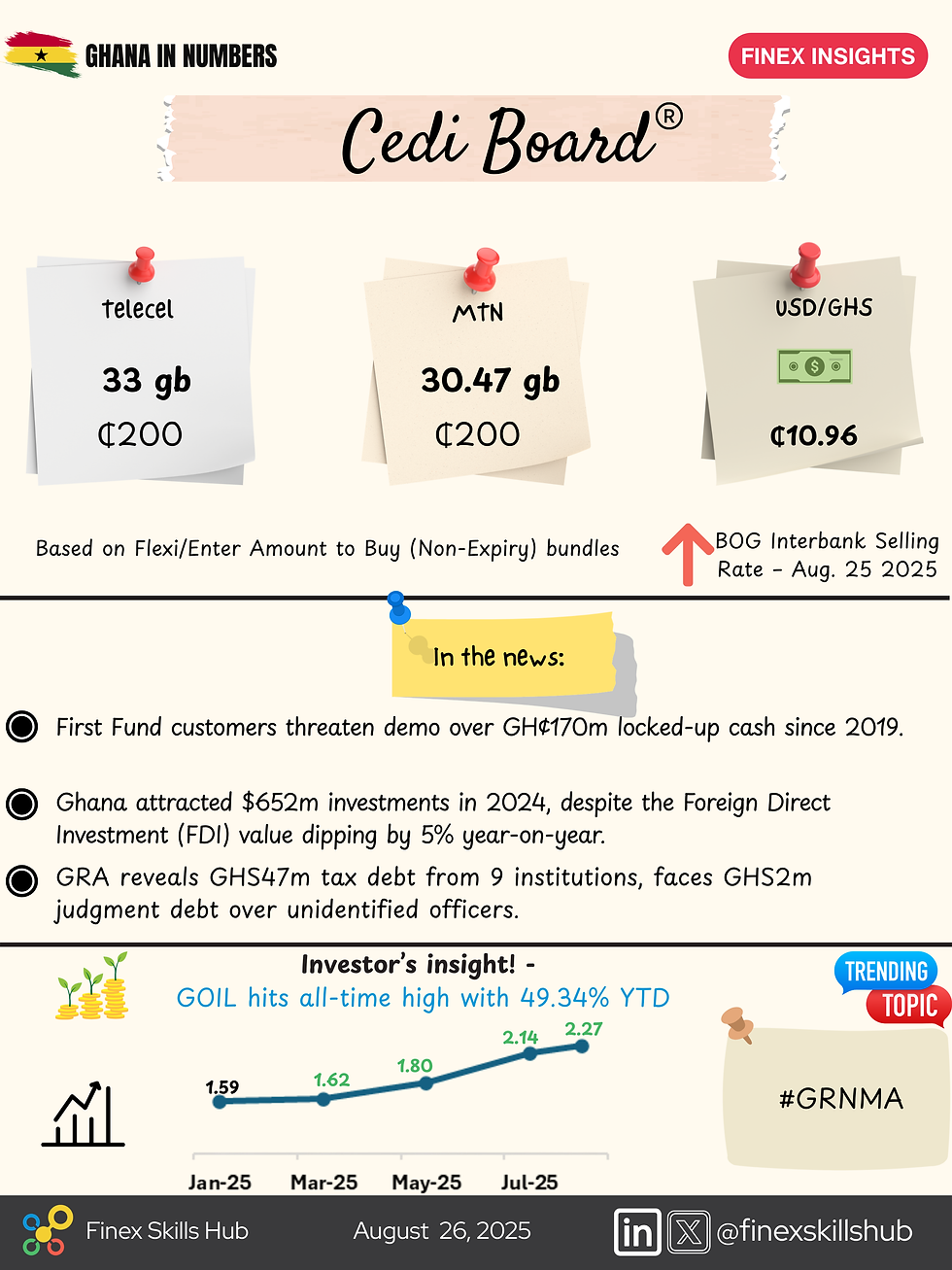

The Ghanaian economy continues to show both resilience and pressure points as new market data emerges. From aggrieved investors demanding their locked-up funds, to steady foreign direct investment inflows and the Ghana Revenue Authority’s tax recovery struggles, today’s Cedi Board update captures the latest financial and economic developments.

First Fund Customers Threaten Protest Over Locked-Up GH¢170m

Thousands of customers of First Fund, an investment scheme formerly managed by the defunct First Banc Financial Services, are demanding urgent action from the Securities and Exchange Commission (SEC).

Six years after the fund manager’s license was revoked, investors, estimated to have over GH¢170 million locked up, say they still cannot access their money.

More than 20,000 investors accuse the SEC of failing to deliver despite appointing multiple fund managers over the years. None of the appointed firms, TTL, OctaneDC, and currently SEM Capital Advisors, have made significant payouts, with SEM still “reconciling accounts.”

Johnny Kwabena Nketiah, a co-convener of the group, warned that a demonstration is imminent if SEC does not act within two weeks.

“Our customers need the money… The only language they understand is demonstration. If nothing changes in two weeks, we will protest,” he said.

The group has vowed to petition the Finance Minister, Dr. Cassiel Ato Forson, and appeal to President John Dramani Mahama to intervene.

Ghana Attracted $652m in Investments in 2024 Despite FDI Dip

Despite a global slowdown in foreign direct investment (FDI), Ghana managed to attract $651.7 million in investments in 2024, according to the Ghana Investment Promotion Centre (GIPC) Q4-2024 Report.

FDI component: $617.6m

Local component: $34.1m

Although the total value dipped by 5% year-on-year, the number of registered projects rose by 11% to 140, signaling investor confidence in Ghana’s economy.

Key highlights:

Top sectors: Services ($281.6m), Manufacturing ($220.6m)

Flagship projects:

Atlantic Terminal Services Limited (Dutch-Ghanaian JV) – $276.9m in port logistics

Jiudine Ghana Corporation Limited (Chinese apparel) – 600+ jobs expected

China led in project numbers (49), while the Netherlands led in investment value ($265.3m).

Regional spread: Greater Accra dominated with 115 projects, but analysts stress the need for investment incentives in northern and rural Ghana.

The 2024 projects are projected to create 15,328 jobs, nearly 90% for Ghanaians.

Improved macroeconomic stability (GDP growth at 7.2% in Q3 2024 and inflation dropping to 23.8% in December) and peaceful elections reinforced Ghana’s investment appeal.

GRA Faces GH¢47m Tax Debt from Institutions

The Ghana Revenue Authority (GRA) is struggling to recover a combined GH¢47 million in unpaid taxes owed by nine institutions, including state-owned enterprises.

At the Public Accounts Committee (PAC) hearing on August 25, Commissioner-General Anthony Kwasi Sarpong revealed that:

The Graphic Communications Group tops the debt list at GH¢3.4m.

GIHOC Distilleries owes GH¢2.1m.

Tema Oil Refinery (TOR) owes GH¢136,000.

In addition, the GRA is facing:

GH¢116m in unpaid VAT liabilities.

GH¢2m judgment debt, resulting from improperly suspending licenses of three companies without due process.

Mr. Sarpong admitted the authority cannot identify the officials responsible for the suspension but pledged intensified efforts to recover the outstanding arrears.

Investor Insight – GOIL Stock Hits All-Time High

Investor confidence extended to the equity market as GOIL Company Limited surged to an all-time high, recording a 49.34% year-to-date gain.

The bullish performance highlights growing investor interest in Ghana’s energy sector amid rising fuel demand and strong earnings growth.

Comments