Ghana’s Economy in Focus: T-Bill Undersubscription, BoG’s Gold Reserve Surge, and $2B Textile Ambition

- bernard boateng

- Aug 11, 2025

- 2 min read

Ghana’s economic indicators this week paint a mixed yet dynamic picture, from a surprise undersubscription in Treasury bill auctions to a record-breaking gold reserve boost and bold plans for the textile sector. The cedi continues its impressive recovery, while investor sentiment remains upbeat on the Ghana Stock Exchange.

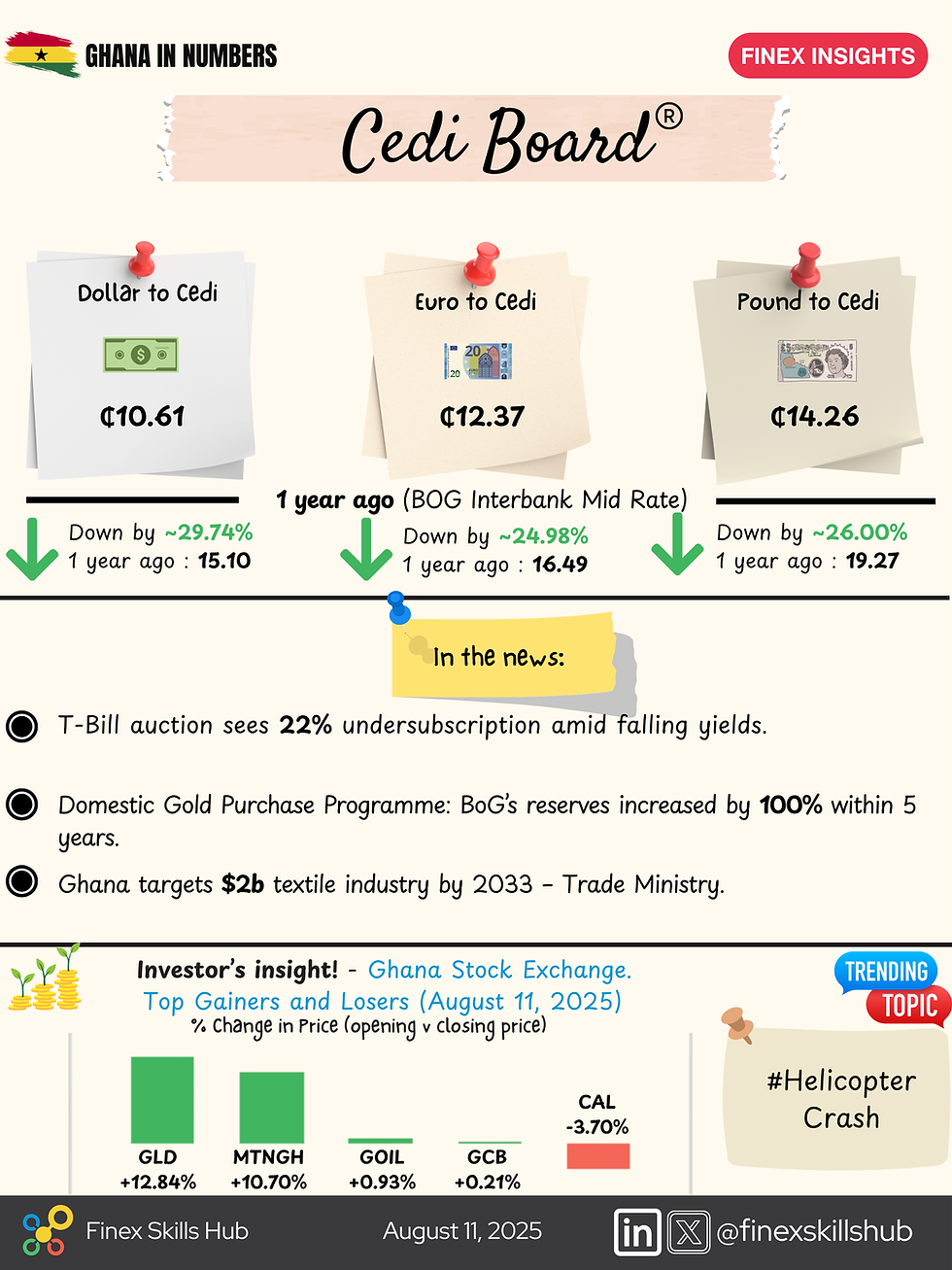

Cedi Strengthens Against Major Currencies

The Ghanaian cedi has posted significant gains year-on-year:

USD/GHS: ₵10.61 (↓29.74% from ₵15.10)

EUR/GHS: ₵12.37 (↓24.98% from ₵16.49)

GBP/GHS: ₵14.26 (↓26.00% from ₵19.27)

These gains reflect a mix of improved forex inflows, prudent monetary policy, and commodity-backed reserve strategies.

T-Bill Auction Sees First Undersubscription in Months

Last week’s Treasury bill auction ended with a 22.12% undersubscription, breaking a three-week streak of oversubscriptions.

Target: GHS 8.58 billion

Raised: GHS 6.69 billion

91-day yield: 10.20% (-0.09%)

182-day yield: 12.25% (-0.10%)

364-day yield: 13.10% (-0.14%)

Analysts attribute the dip in demand to the government’s rejection of high-yield bids and increased liquidity flows into mid-week BoG auctions, which attracted GHS 6.2 billion ahead of Friday’s sale.

BoG Doubles Gold Reserves in Five Months

The Domestic Gold Purchase Programme has propelled the Bank of Ghana’s reserves to 34.40 tonnes, a 100% increase since June 2021.

Since inception, the programme has:

Purchased 145.95 tonnes of gold

Sold 86.77 tonnes for forex

Allocated 27.63 tonnes for the Gold for Oil (G4O) initiative

According to First Deputy Governor Dr. Zakari Mumuni, the programme is not just about reserve accumulation but also leveraging Ghana’s commodity base to secure cheaper financing and hedge against global currency volatility.

Textile Industry Eyes $2B Milestone by 2033

The Ministry of Trade, Agribusiness and Industry has unveiled a Textile and Garment Manufacturing Policy targeting:

$2 billion industry value

$1.2 billion in new investments

150,000 jobs (direct & indirect)

50,000 hectares of large-scale cotton cultivation

Deputy Minister Samson Ahi emphasised that these goals are achievable through collaboration, while Labour Minister Dr. Abdul-Rashid Pelpuo called for competence-driven hiring to ensure inclusive, sustainable job creation.

Investor’s Insight: MTN Ghana Shines

Top daily performers included:

GLD ETF: +12.84%

MTNGH: +10.70%

GOIL: +0.93%

GCB: +0.21%

CAL Bank dipped -3.70%. With falling T-bill yields, equities like MTN Ghana could attract more portfolio inflows.

Ghana’s economic story this week is one of strategic repositioning, with the BoG fortifying reserves, the textile sector aiming for industrial transformation, and the cedi holding strong. However, the T-bill undersubscription signals a need to watch liquidity flows and interest rate dynamics closely.

Stay tuned to the Cedi Board® for real-time updates on Ghana’s financial pulse. From prices and policy to investment tips that help you make sense of the numbers.

Comments