Ghana’s Inflation Falls to 8%: Stability at Last, Even If Prices Stay High.

- Connect Finex

- Nov 5, 2025

- 2 min read

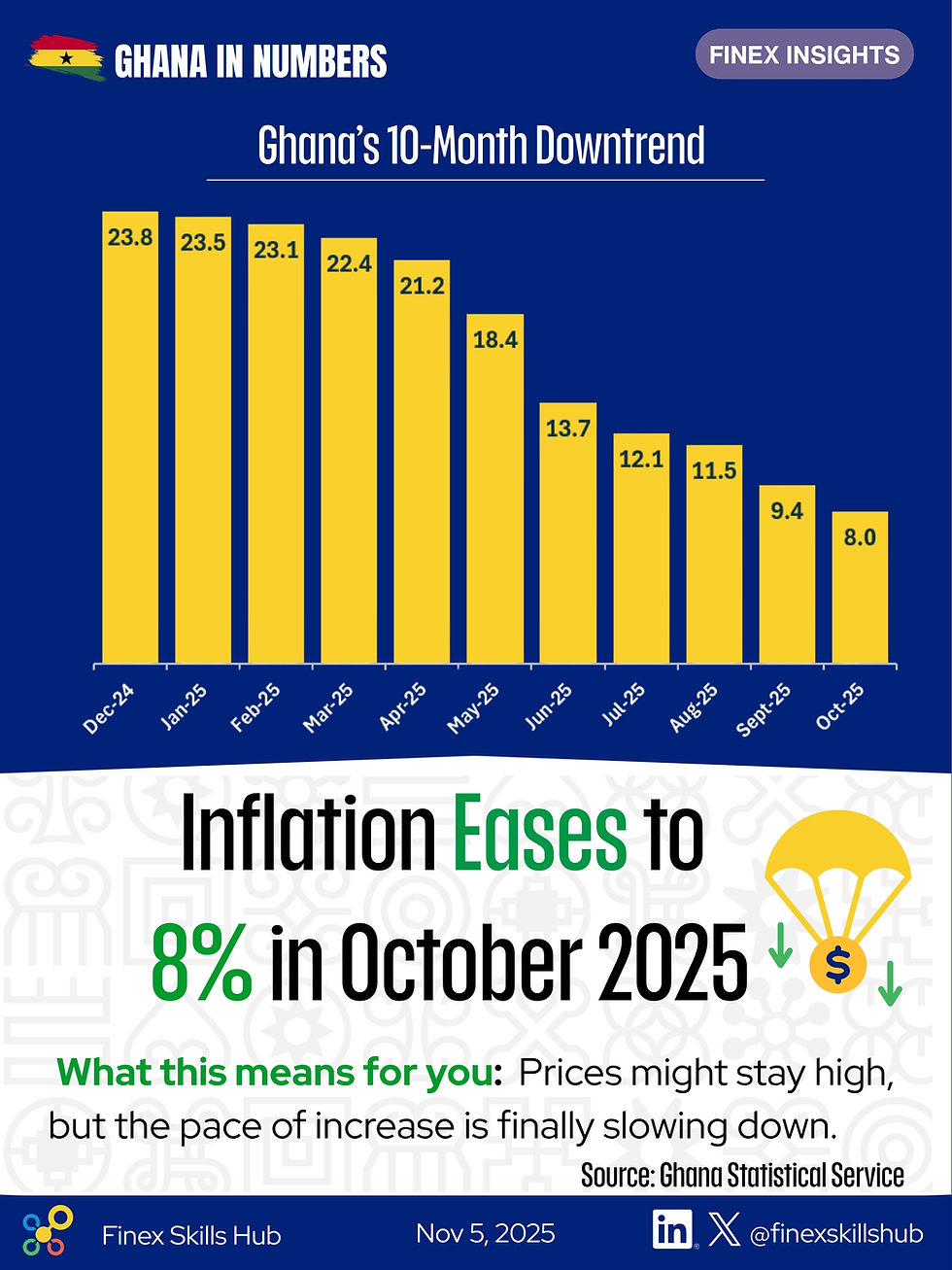

Ghana’s inflation rate has cooled to 8% in October 2025, the lowest level since early 2021, according to the Ghana Statistical Service. It marks the tenth straight month of decline, capping a dramatic reversal from the 23.8% recorded in December 2024.

But beyond the numbers lies a more meaningful story for households: prices aren’t necessarily dropping. They’ve just stopped climbing so fast. After years of unpredictable jumps, this stability feels like the first real relief many Ghanaians have had in a while.

From Pain to Pause

For most of 2023 and 2024, inflation was Ghana’s everyday headache. The cost of food, rent, and transport soared, eroding disposable incomes and stretching budgets thin. Then, beginning in early 2025, the pace of price hikes started to ease.

In many markets, traders now say the storm has calmed. A bag of rice that went for around GHS 100 at the height of the crisis might now be closer to GHS 120 instead of GHS 200 ,not cheaper, but far more stable. (Figures are illustrative.)

For families, that difference matters. Trotro fares have held steady for months, and food prices though high no longer change from one week to the next. “In a country where yesterday’s price was never today’s price, stability feels like progress.

Why Inflation Is Cooling

Economists point to a mix of domestic discipline and favorable external trends:

Better harvests improved food supply, easing pressure on staples like maize and rice.

A steadier cedi helped limit imported inflation.

Falling oil prices cut fuel and transport costs.

The Bank of Ghana’s firm policy stance reined in money supply and inflation expectations.

Together, these factors helped cool inflation from 23.8% in December 2024 to 8% by October 2025.

Predictability Over Relief

Still, the improvement hasn’t yet translated into visibly lower prices for most people. Rent, school fees, and daily food costs remain stubbornly high. But the big shift is predictability, and that makes a real difference.

Businesses can plan stock purchases with less fear of tomorrow’s prices. Families can budget for transport and food without constant surprises. For a population worn out by economic shocks, stability feels like breathing room.

Cautions Beneath the Progress

The headline may sound comforting, but the picture isn’t all rosy. Service inflation particularly in rent and education remains high. Wages haven’t caught up with the cumulative cost of living from previous years. And while inflation is falling, interest rates remain steep, keeping credit out of reach for small businesses and households.

The Road Ahead

If Ghana sustains single-digit inflation through early 2026, it could pave the way for lower interest rates and a healthier growth cycle. But risks remain: currency pressures, and volatile oil prices could easily slow the progress.

Still, after years of turbulence, the broader trend is encouraging. Inflation may be down not because prices are falling, but because they’re finally holding steady.

And for millions of Ghanaians, that stability, however modest, is a quiet but powerful form of relief.

Ghana inflation October 2025, inflation rate Ghana 2025, Ghana Statistical Service, cost of living Ghana, Bank of Ghana, Ghana economy, Ghana inflation news, Ghana inflation analysis

Comments