Ghana’s producer inflation falls to 3.8% as BoG tightens forex rules and rice imports rise

- bernard boateng

- Aug 21, 2025

- 3 min read

Ghana’s economy is going through a mix of encouraging and challenging developments, with fresh updates on producer inflation, food imports, and foreign exchange management shaping the outlook for businesses and consumers.

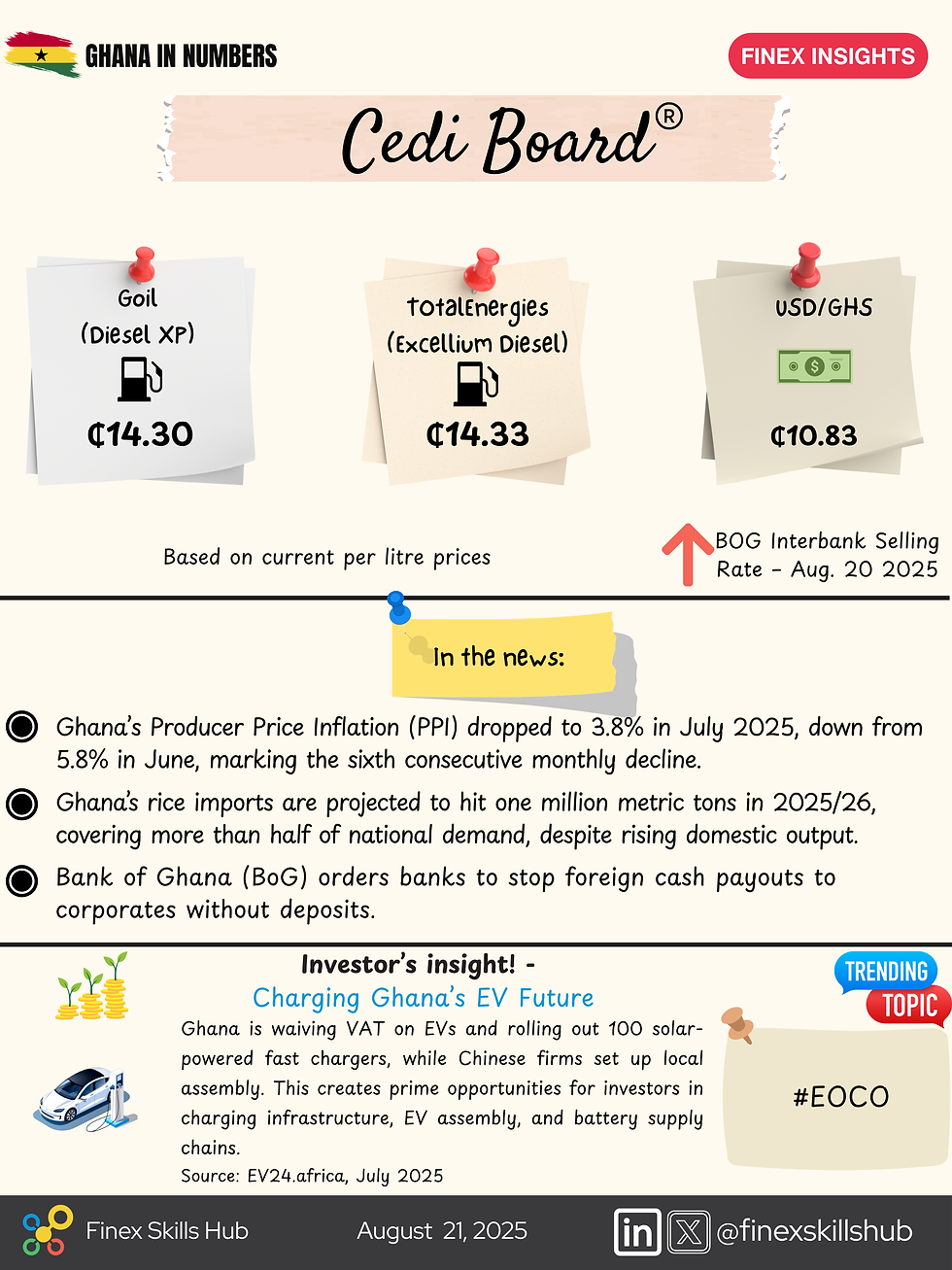

Producer Price Inflation (PPI) Falls to 3.8% in July 2025

Ghana’s Producer Price Inflation (PPI) dropped sharply to 3.8% in July 2025, down from 5.8% in June, according to the latest figures from the Ghana Statistical Service (GSS). This marks the sixth consecutive monthly decline and the lowest level since November 2023.

Key drivers of the decline:

Mining & Quarrying (43.7% weight): Inflation eased to 4.6%, down from 6.5% in June.

Manufacturing (35% weight): Inflation dropped significantly to 3.6%, compared to 7.2% in June.

Transport: Costs continued to fall, now at -8.1%.

Hotels & Restaurants: Inflation remained stable at 2.6%.

The GSS highlighted that while falling producer costs could ease economic pressures, businesses should not rely solely on price reductions but instead innovate, renegotiate contracts, and rethink strategies.

For consumers, the message was clear: lower producer costs should ideally translate into lower retail prices, so buyers should monitor markets closely and demand fair pricing.

For government, the call was to sustain macroeconomic stability and support key sectors like mining and manufacturing with targeted incentives.

Ghana’s Rice Imports Projected to Hit One Million Metric Tons in 2025/26

Despite rising domestic production, Ghana’s rice imports are projected to hit one million metric tons in the 2025/26 season, covering more than half of the country’s demand, according to the U.S. Department of Agriculture (USDA) 2025 Grain and Feed Report.

Highlights from the report:

Production: Expected at 900,000 metric tons, an 18% rise due to improved farmer participation and favorable weather.

Consumption: Projected to reach 1.80 million metric tons, up from 1.75 million MT.

Imports: Largely from Vietnam, India, and Thailand, which supply about 70% of Ghana’s rice.

Price fluctuations remain a concern. Between March 2024 and January 2025, the average price of a 100kg bag of rice surged from GH¢200 to GH¢650, before easing to GH¢400 in March 2025.

Imported rice still dominates pricing:

Thai fragrant rice: GH¢690 (25kg bag)

Vietnamese rice: GH¢490

Local long-grain rice: GH¢535

The USDA cautioned that Ghana’s local rice sector faces structural challenges, including poor irrigation, low mechanization, and weak processing. Without urgent reforms, Ghana will remain heavily dependent on imports and vulnerable to global price shocks and exchange rate volatility.

Bank of Ghana Orders Stricter Rules on Foreign Currency Payments

The Bank of Ghana (BoG) has issued a new directive requiring commercial banks to stop making foreign currency cash payments to large corporates unless such withdrawals are backed by equivalent deposits.

Key points of the directive:

Applies to large corporates such as bulk oil distributors and mining companies.

Aimed at reducing unnecessary pressure on Ghana’s foreign exchange market.

Banks must ensure that foreign cash withdrawals are fully supported by prior deposits at the BoG.

The central bank explained that unrestricted withdrawals undermine exchange rate stability. To mitigate this, it has partnered with government to ensure forex liquidity is available for legitimate import needs.

BoG also warned that non-compliance would attract sanctions, urging banks to apply forex resources efficiently and transparently.

This move is expected to strengthen forex market stability while ensuring that key supply chains, including petroleum and minerals, remain protected.

Ghana’s economy is navigating a delicate balance: easing producer inflation provides hope for lower costs, yet heavy rice imports continue to expose vulnerabilities in agriculture. Meanwhile, the Bank of Ghana’s forex directive signals a determined push to protect the cedi and maintain stability.

For businesses, these developments mean reviewing pricing strategies, preparing for stricter forex compliance, and exploring opportunities in local production. For consumers, they highlight the importance of making informed choices and demanding fairer retail pricing.

Stay tuned for more insights in the next Cedi Board update.

Comments