GoldBod Revenue Hits GH¢691m as Banking Sector Non-Performing Loans Decline to 19.5%

- Connect Finex

- Nov 28, 2025

- 4 min read

Today’s financial data presents a distinct picture of recovery and consolidation across key sectors. The markets are reacting to a mix of rising commodity values and a significant jump in the Ghana Stock Exchange Composite Index. Beyond the trading charts, the economic narrative is dominated by robust Q3 earnings from the Gold Board and a notable improvement in banking asset quality, even as the nation observes a solemn state funeral. Let's analyze the latest data and emerging trends shaping Ghana's economic landscape.

Market Movers

The commodities and equity markets for today, November 28, 2025, reflect a trend of growing investor confidence and asset accumulation.

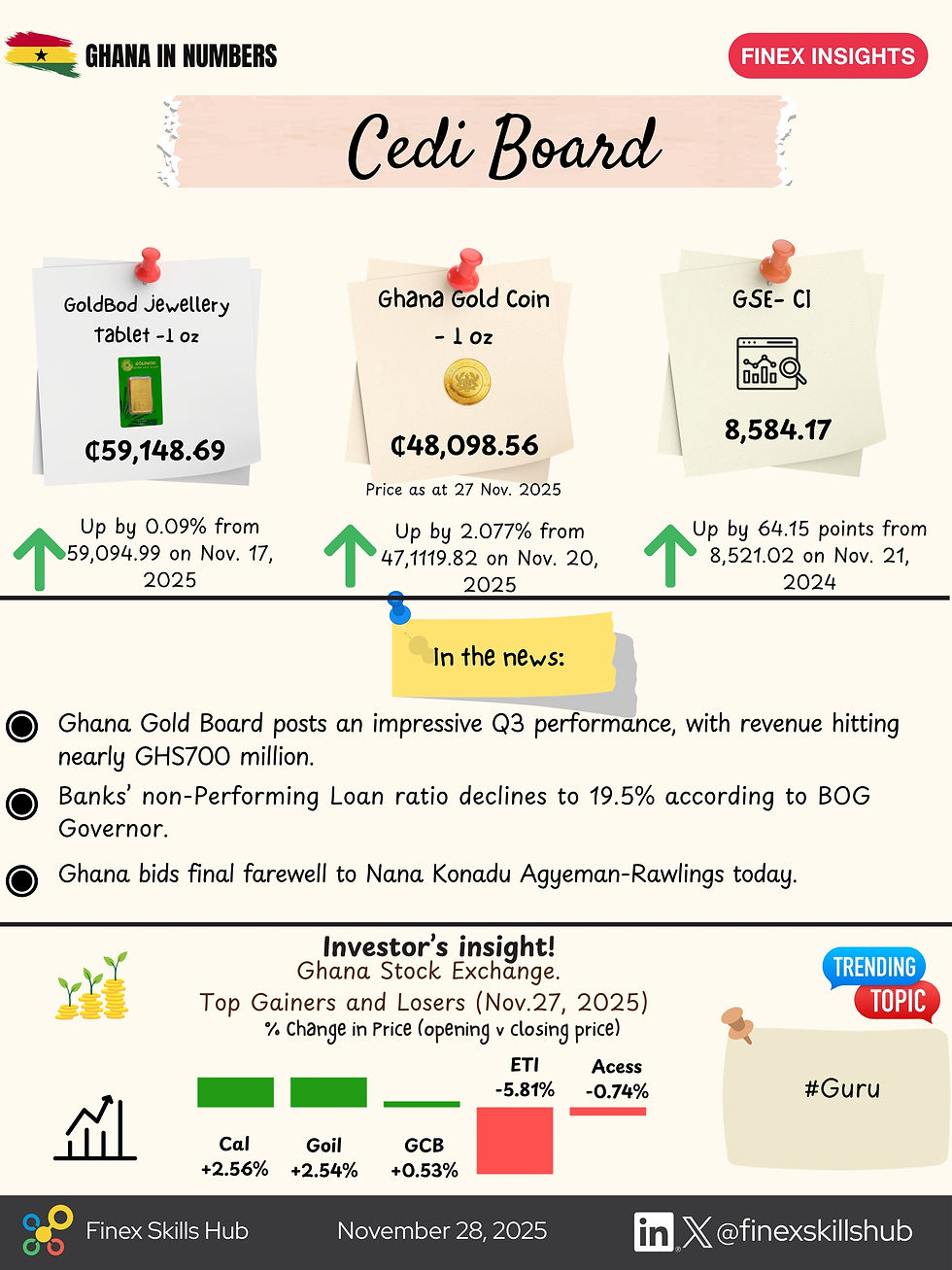

Ghana Gold Coin: The standout performer in the commodities bracket is the Ghana Gold Coin, which is trading at GH¢48,098.56 per ounce. This represents a significant 2.077% increase from the price recorded on November 20. This upward movement suggests that domestic investors are increasingly utilizing the gold coin as a store of value to hedge against potential currency fluctuations.

GoldBod Jewellery: The one-ounce gold tablet saw a modest appreciation, rising by 0.09% to trade at GH¢59,148.69. While the growth is slower compared to the coin, the stability in price indicates sustained demand for physical gold assets.

GSE-CI: On the equities front, the Ghana Stock Exchange Composite Index (GSE-CI) recorded a robust gain, climbing by 64.15 points to close at 8,584.17. This surge implies a renewed appetite for Ghanaian equities, likely buoyed by the positive banking sector news discussed below.

Key Headlines

GoldBod Posts GH¢691m Q3 Revenue

The Ghana Gold Board (GoldBod) has reported a total revenue of GH¢691.14 million for the third quarter of 2025. This performance appears to be the result of a dual strategy involving robust gold aggregation and strong export figures. The data reveals that exports reached a combined value of US$5.1 billion, with the Artisanal and Small-scale Mining (ASM) sector contributing significantly by exporting over 25,000 kilograms of gold.

For the economy, this revenue mobilization suggests that the formalization of the ASM sector is yielding fiscal results. Furthermore, the Board’s acquisition of approximately 120 kilograms of gold for the Bank of Ghana’s reserves indicates a deliberate effort to strengthen the national currency backing. With a comprehensive income of GH¢637.39 million after expenses, the Board’s financial health appears stable, which could provide the government with increased fiscal space in the coming months.

Banks’ Non-Performing Loan Ratio Declines to 19.5%

In a development that signals improved financial stability, the Bank of Ghana Governor, Dr. Johnson Pandit Asiama, announced that the banking sector's Non-Performing Loan (NPL) ratio dropped to 19.5% in October 2025. This is a decrease from the 22.7% recorded during the same period last year. The decline is attributed to enhanced credit underwriting standards and a contraction in the overall stock of bad debts.

This reduction is significant for the everyday Ghanaian and business owners. A lower NPL ratio typically correlates with a healthier banking sector that is more willing to lend. Coupled with the recent decision to lower the monetary policy rate to 18.0%, this trend implies that access to credit could improve, and interest rates on loans might eventually moderate. However, the Governor noted that credit risks remain elevated, suggesting that while the trend is positive, banks will likely maintain a cautious approach to lending in the short term.

Ghana Bids Farewell to Nana Konadu Agyeman-Rawlings

The nation pauses today to observe the state funeral of former First Lady Nana Konadu Agyeman-Rawlings at the Black Star Square. Passing away at age 76, she leaves a legacy defined by her role as the country’s longest-serving First Lady and her advocacy through the 31st December Women's Movement.

From a socio-economic perspective, her work laid early frameworks for women's economic empowerment in Ghana. The state-assisted burial has drawn dignitaries from across the region, resulting in a temporary slowdown of administrative activities in the capital today. The event marks a historical transition, closing a significant chapter in Ghana's political narrative.

Investor’s Insight

Ghana Stock Exchange: Top Gainers and Losers (Nov. 27, 2025)

The trading session ending November 27 highlighted a clear preference among investors for indigenous stocks, particularly in the energy and banking sectors.

Gainers: Cal Bank led the market with a 2.56% increase in share price, followed closely by Goil at 2.54% and GCB Bank at 0.53%. The rise in banking stocks such as Cal and GCB likely reflects investor optimism stemming from the improved NPL data released by the central bank.

Losers: Conversely, pan-African banking stocks faced selling pressure. ETI (Ecobank) saw a significant decline of 5.81%, while Access Bank dipped by 0.74%.

This divergence suggests that investors are rebalancing their portfolios. There appears to be a rotation out of regional banking stocks and into local entities that show resilience and potential alignment with the recovering domestic macroeconomic indicators.

Trending Topic: #Guru

The hashtag #Guru is currently dominating social media conversations in Ghana. The topic centers on Maradona Yeboah Adjei, the popular musician and current SRC President of the University of Ghana. The trend stems from a controversy regarding the prizes awarded for the "Miss University of Ghana 2025" pageant.

The winner of the pageant publicly alleged that the "brand-new" car promised as the grand prize was in poor mechanical condition and that other incentives, specifically a trip to Dubai, were not honored. The controversy intensified following a response from the SRC President, which many users on platforms like X (formerly Twitter) interpreted as dismissive. This incident has triggered a wider debate regarding accountability in student leadership and the management of corporate sponsorships within university institutions.

Conclusion

Today’s data offers a narrative of stabilization and growth within the formal economy. The combination of GoldBod’s strong revenue performance and the decline in banking NPLs points toward a strengthening macroeconomic framework. While the stock market reflects this optimism through gains in local equities, the trending discourse around student leadership serves as a reminder of the importance of governance and transparency. As the nation mourns a historic figure, the economic indicators suggest a resilient path forward for the remainder of the quarter.

Follow Finex Skills Hub for daily insights into Ghana's economic pulse.

Comments