Macroeconomic Gains vs. Digital Risks: T-Bills & Inflation Fall, But Cybercrime Costs Ghana GH¢15m

- bernard boateng

- Sep 4

- 3 min read

Ghana's macroeconomic landscape continues to show signs of robust recovery, with key indicators like Treasury bill rates and inflation falling significantly. However, this positive fiscal story is unfolding alongside growing digital threats and strategic shifts in the foreign exchange market, painting a complex picture of an economy in transition.

T-Bills and Inflation Show Sustained Improvement

The data from the Cedi Board reveals a story of remarkable macroeconomic progress.

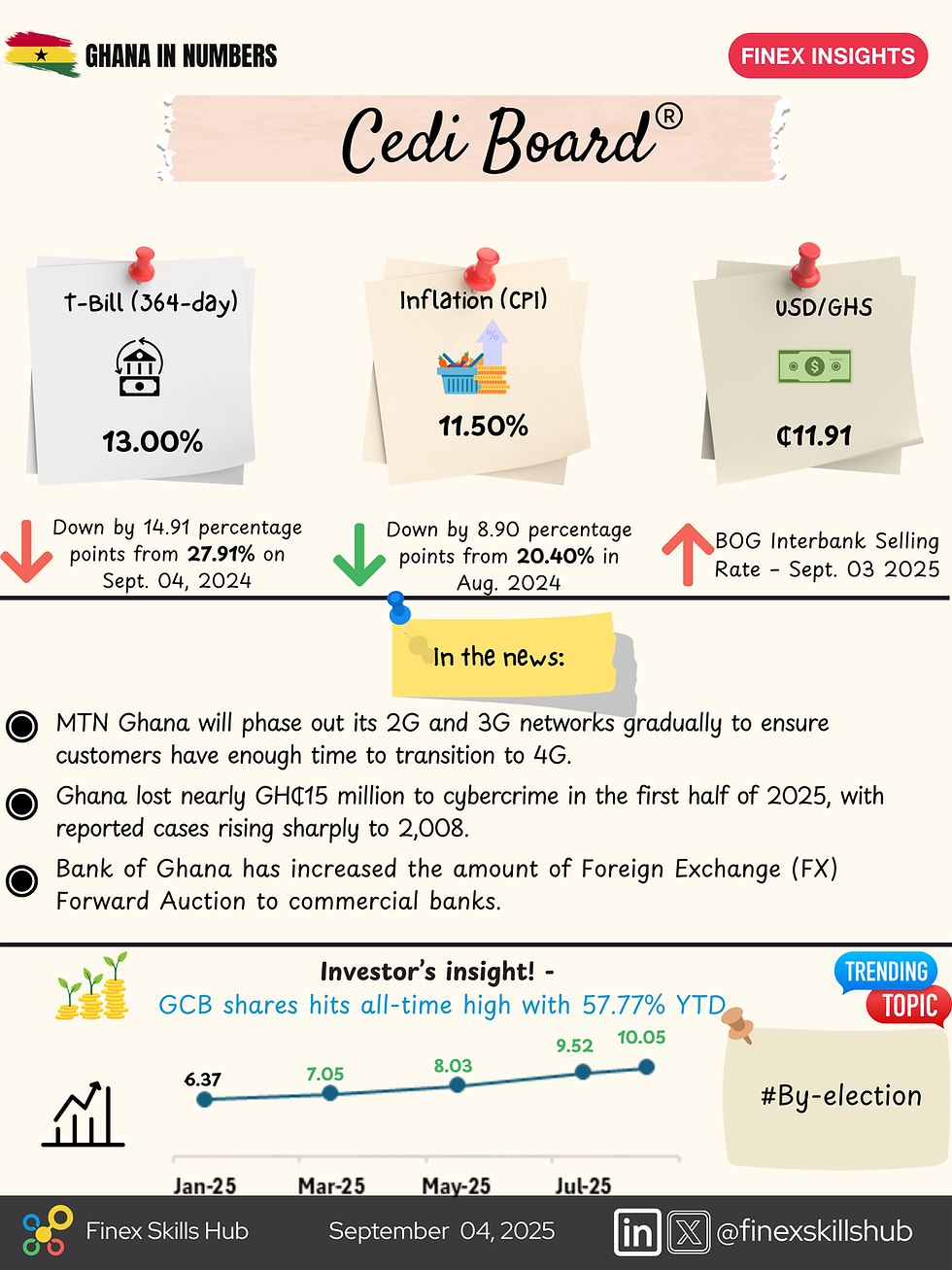

The yield on the 364-day Treasury bill has plummeted to 13.00%, a dramatic drop of 14.91 percentage points from the 27.91% recorded just one year ago.

This positive trend is mirrored in the inflation rate. The Consumer Price Index (CPI) now stands at 11.50%, down by 8.90 percentage points from the 20.40% reported in August 2024.

This sustained decline signals increasing investor confidence and more effective monetary policy management, creating a more stable environment for business and investment.

MTN Ghana to Phase Out 2G and 3G Networks Gradually

In the telecom sector, MTN Ghana has announced a cautious, customer-centric approach to phasing out its legacy 2G and 3G networks. CEO Stephen Blewett emphasized that the transition to a 4G-dominated network must be inclusive.

“A lot of our customers are still operating on 3G... Some choose to stay on 3G because they feel data usage is faster on 4G. Others, however, use older devices that don’t support 4G.”— Stephen Blewett, CEO of MTN Ghana

He warned that a rushed shutdown without affordable 4G device availability would risk disenfranchising a significant portion of their user base. This move is part of a broader industry effort to optimize spectrum use for more advanced services.

Cybercrime Spikes, Costing Ghana GH¢15 Million in H1 2025

The nation's digital advancement is facing a severe counter-threat. The Cyber Security Authority (CSA) has reported a sharp and alarming rise in cybercrime.

Financial losses nearing GH¢15 million in the first half of 2025.

Reported cases surged 53% from 1,317 in H1 2024 to 2,008 in H1 2025.

Top Crimes: Online fraud (36%), cyberbullying (25%), and online blackmail (14%).

CSA Director-General Divine Selasi Agbeti linked the rise to Ghana’s deepening digitalization, stating the trend "breeds distrust and undermines national security efforts." The authority has launched its 2025 Cybersecurity Awareness Month under the theme “Building a Safe, Informed, and Accountable Digital Space” to combat this trend.

Bank of Ghana Adjusts FX Strategy Amid Cedi Pressures

On the currency front, the Bank of Ghana (BoG) is making strategic adjustments to manage liquidity pressures.

The Central Bank recently increased its Foreign Exchange (FX) Forward Auction to commercial banks, selling $208 million in a 7-day auction after initially offering $100 million.

This move comes as the BoG's FX sales dropped by over 18% from July to August 2025. Some commercial banks have argued that this limited supply has contributed to recent pressure on the Cedi, which is now quoted at GH¢11.91 on the interbank market.

BoG Governor Dr. Johnson Asiama assured that the bank is implementing a strategic intervention policy, which includes directing mining firms to sell their forex inflows directly to commercial banks to improve market liquidity.

Investor’s Insight – GCB Bank Hits New High with 57.77% YTD Gain

Amidst these dynamics, the equity market presents a bright spot.

GCB Bank shares have surged to a new all-time high, recording an impressive 57.77% year-to-date gain.

This sustained performance reflects strong investor confidence in the bank's fundamentals and a positive outlook on Ghana's banking sector resilience.

The dichotomy is clear: while macroeconomic fundamentals are strengthening impressively, new-age challenges in cybersecurity and digital inclusion require urgent and focused policy attention. The BoG's nuanced approach to FX management demonstrates a careful balancing act between supporting the Cedi and preserving foreign reserves. For investors, the stellar performance of blue-chip stocks like GCB offers attractive opportunities, but the rising tide of cybercrime serves as a stark reminder that digital risk is now a critical factor in the investment landscape.

Stay tuned to the Cedi Board® for real-time updates on Ghana’s financial pulse. From prices and policy to investment tips that help you make sense of the numbers.

Comments