Star Oil Dethrones GOIL as Govt Decides to Pay GH₵4 Billion Debt

- bernard boateng

- Jul 9, 2025

- 3 min read

In today’s Cedi Board® update, we spotlight critical national developments ranging from a planned nationwide power outage to shifting dynamics in Ghana’s petroleum sector and major government disbursements. With key indicators holding steady and investor confidence building, here’s what’s driving economic conversation across the country this week.

Nationwide Power Interruption Set for July 13, Says Energy Minister

Ghana’s Minister for Energy and Green Transition, John Abdulai Jinapor, has announced a nationwide power outage scheduled for Sunday, July 13, due to planned maintenance by gas supplier ENI. The temporary shutdown of gas valves is necessary to rehabilitate infrastructure and expand gas production to 270 million standard cubic feet per day (MMscf).

“This temporary inconvenience is a strategic move to stabilise and strengthen our energy sector,” Jinapor said during the commissioning of the Anwomaso-Kumasi transmission line on July 8.

He emphasized that thermal plants would not transition to liquid fuel during the brief interruption, based on technical guidance, and reassured Ghanaians that all necessary steps are being taken to minimise impact.

The project, co-funded by the European Union and the French government, is expected to significantly improve power supply and resolve low-voltage issues in Kumasi and key mining towns.

Star Oil Surpasses GOIL to Lead Petroleum Sales in 2025

Star Oil has emerged as the top-performing oil marketing company in Ghana for the first five months of 2025, overtaking GOIL in petroleum product sales.

According to National Petroleum Authority (NPA) data:

Star Oil sold 336.3 million litres (Jan–May 2025)

GOIL followed with 271.3 million litres

Vivo Energy (Shell): 206 million litres

TotalEnergies: 149 million litres

Zen Petroleum: 82 million litres

In total, 2.4 billion litres of petroleum products were sold nationwide across over 200 firms during the period. Star Oil’s strong performance reflects expanding market share, with 403 million litres sold in H1 2025, backed by a national footprint of 240 stations and 2,546 direct employees.

The company also contributed GH₵1.1 billion in taxes to the state during the first half of the year, showcasing both operational strength and fiscal responsibility.

Government to Settle GH₵4 Billion in Contractor Arrears

Ghana’s road infrastructure sector is set to receive a financial boost as the government prepares to disburse GH₵4 billion to settle part of its GH₵21 billion owed to road contractors.

Minister for Roads and Highways, Kwame Governs Agbodza, revealed that many contractors have halted work due to unpaid certificates dating back as far as 2018.

“Most contractors were off-site during the government transition due to unpaid certificates. It was not feasible to continue working without reimbursement,” the minister noted.

The GH₵4 billion payment, expected by the end of July, is aimed at reactivating stalled projects nationwide and restoring confidence among contractors. The government says this marks the beginning of a broader debt settlement process under the new administration.

Market Indicators: What’s Changed?

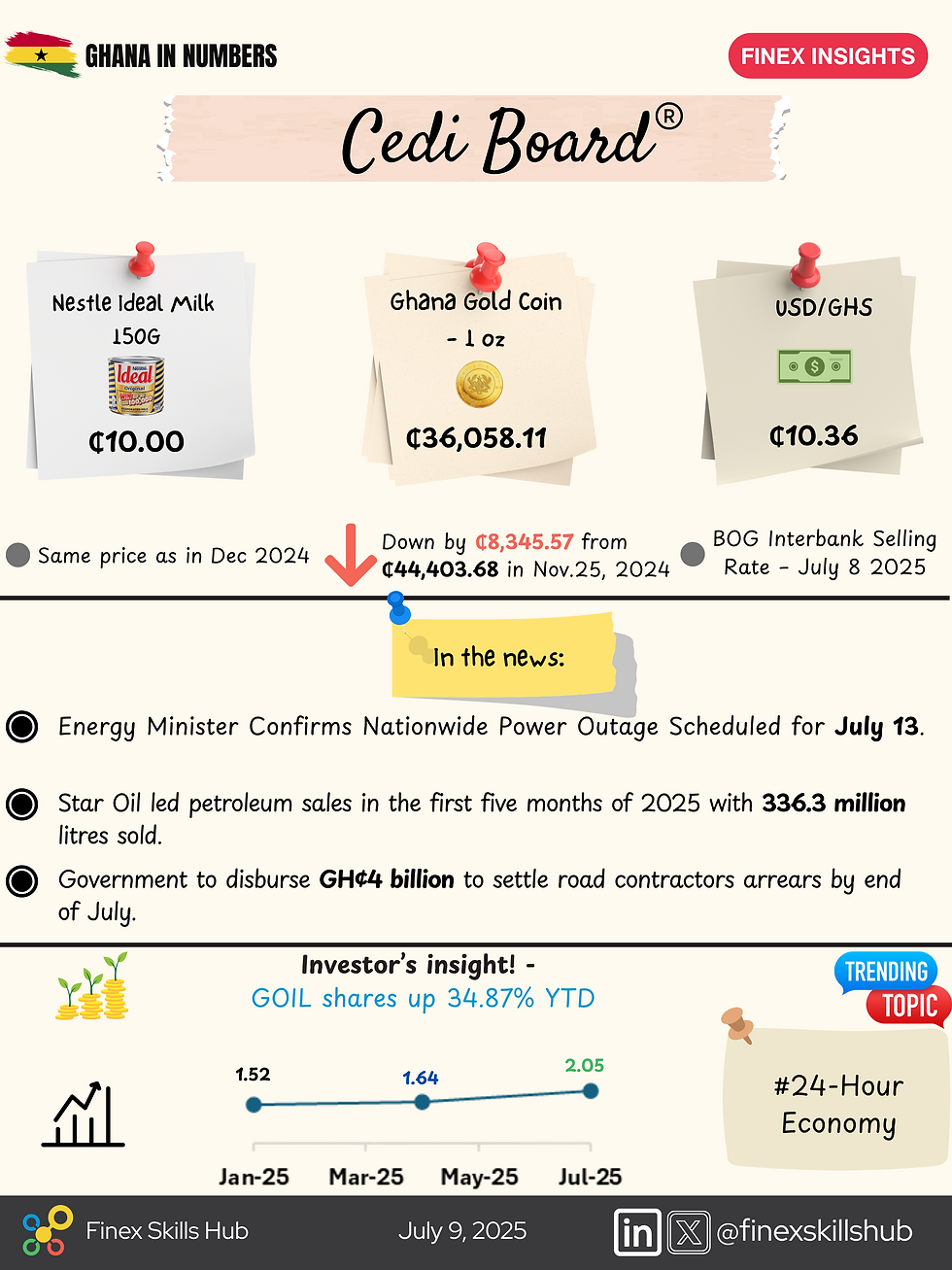

USD/GHS interbank rate as of July 8, 2025: GH₵10.36

Ghana Gold Coin (1 oz): GH₵36,058.11, down by GH₵8,345.57 from November 2024.

Nestle Ideal Milk (150g): Holding steady at GH₵10, same as December 2024.

These mixed market trends reflect both currency stability and commodity adjustments, shaped by global market conditions and Ghana’s domestic recovery.

Investor’s Insight: GOIL Shares Up 34.87% YTD

In capital market news, GOIL shares have surged 34.87% year-to-date, rising from GH₵1.52 in January to GH₵2.05 by early July 2025. The upward trend signals renewed investor interest in energy sector stocks amid improving macroeconomic stability.

As always, investors are advised to assess fundamentals and monitor quarterly earnings, especially with petroleum firms increasingly diversifying operations.

Stay tuned to the Cedi Board® for real-time updates on Ghana’s financial pulse. From prices and policy to investment tips that help you make sense of the numbers.

Comments