Oil Revenue Surge, Cedi Among Africa’s Top 4 Currencies, T-bills Oversubscribed

- bernard boateng

- Jul 28, 2025

- 2 min read

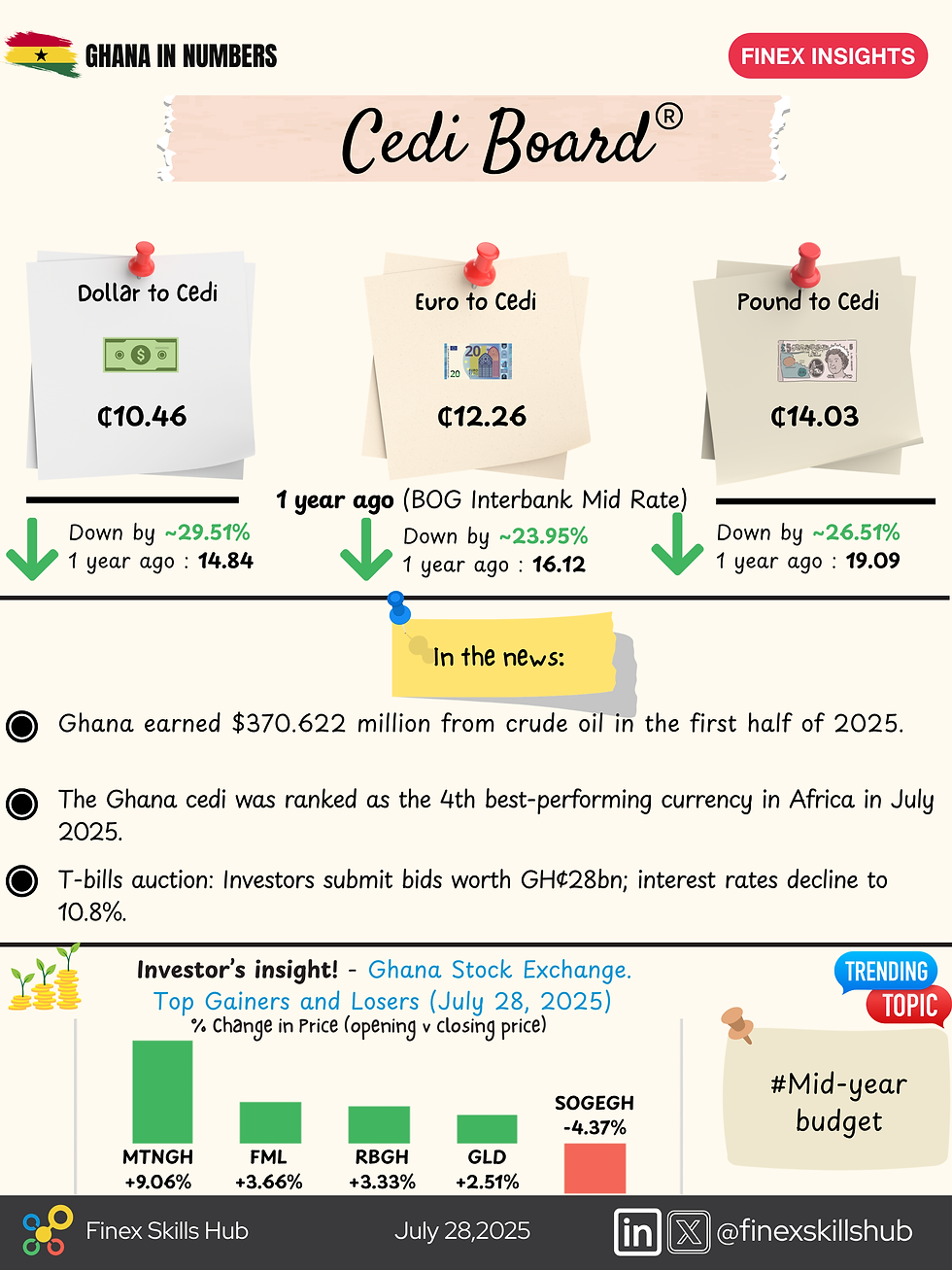

The Ghanaian economy received a major boost in the first half of 2025, with developments in oil revenue, currency performance, and treasury bill auctions reflecting renewed investor confidence and fiscal discipline.

Ghana Earns Over $370 Million from Crude Oil in H1 2025

Ghana earned approximately $370.622 million from crude oil operations between January and June 2025, according to the First-Half Petroleum Semi-Annual Report. Of this amount, $218.62 million came from crude oil liftings between January and March, while $148.75 million was raised from corporate taxes paid by oil companies including Kosmos Energy, Tullow Oil, ENI Ghana, Vitol, and Petro SA.

Additional inflows included $863,045 from surface rentals and $2.376 million from the Petroleum Holding Fund. Investment income from the Ghana Petroleum Funds reached $1.424 billion, with the Ghana Heritage Fund accounting for $1.301 billion, and the Ghana Stabilisation Fund contributing $122.9 million. These inflows underline Ghana’s improving oil revenue management and long-term fund accumulation strategy.

Ghana Cedi Ranked 4th Best-Performing Currency in Africa

The Ghana cedi has continued its strong performance in 2025, emerging as the 4th best-performing currency on the African continent this July. Trading at GH¢10.42 per USD, the local currency recorded a year-to-date gain of around 30%, according to Forbes Currency Converter data.

The cedi was outpaced only by the Tunisian dinar, Libyan dinar, and Moroccan dirham. Analysts credit the cedi’s resilience to Ghana’s enhanced international reserves, equivalent to over four months of import cover, and the implementation of a reform-aligned 2025 budget.

The International Monetary Fund also reaffirmed its support, highlighting Ghana’s bold corrective actions in response to past policy slippages. The IMF noted that the government’s efforts are aligned with economic stabilisation, structural reforms, and inclusive growth targets.

Government Sees 264% Oversubscription in T-bill Auction

Just a day after the Mid-Year Budget Review, Ghana’s government witnessed an extraordinary 264% oversubscription in treasury bill auctions. According to the Bank of Ghana, total bids amounted to GH¢28.096 billion, far surpassing the GH¢7.07 billion target.

The government accepted GH¢15.16 billion, with the 91-day bill receiving GH¢13.435 billion in bids, out of which GH¢5.078 billion was accepted. The 182-day and 364-day bills also saw significant participation, with accepted bids of GH¢5.723 billion and GH¢4.358 billion, respectively.

This strong investor appetite occurred as interest rates declined across all short-term securities. The 91-day bill rate dropped by 289 basis points to 10.83%, the 182-day bill fell to 13.22%, and the 364-day bill declined to 14.30%. Market watchers anticipate a reduction in the government's borrowing costs due to these lower yields.

Market Snapshot: Ghana Stock Exchange – July 28, 2025

Investor sentiment was mostly positive on the Ghana Stock Exchange. Leading the charge was MTNGH, gaining +9.06%, followed by FML (+3.66%), RBGH (+3.33%), and GLD (+2.51%). The only major loser was SOGEGH, which fell by -4.37%.

Stay tuned to the Cedi Board® for real-time updates on Ghana’s financial pulse. From prices and policy to investment tips that help you make sense of the numbers.

Comments