TOR's Comeback, Major Fraud Charges, and a Life-Saving Policy Shift: Ghana's Economic Pulse

- bernard boateng

- Oct 14, 2025

- 2 min read

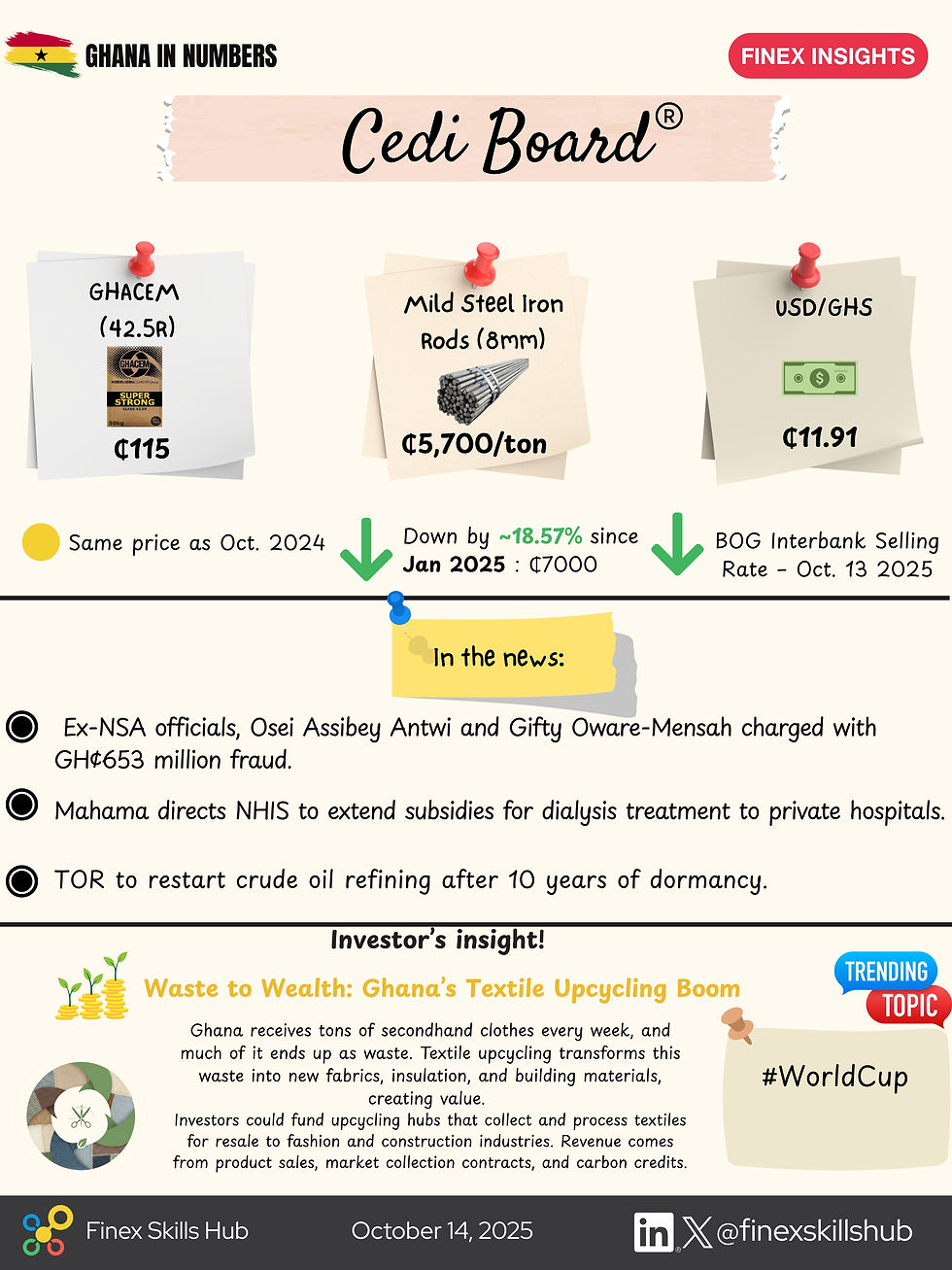

The Market Snapshot

The price of GHACEM cement, grade 42.5R is currently ₵115, holding the same price as October 2024. There has also been an impactful decrease in the price of Mild Steel Iron Rods (8mm) to ₵5,700 per ton, down from ₵7,000 earlier this year. This significant drop should bring relief to the construction sector, potentially lowering the cost of building homes and infrastructure. The Bank of Ghana (BOG) Interbank Selling Rate pegs the dollar at GH\c11.91, in the official market.

Major Policy and Anti-Corruption Signals

The news highlights crucial policy adjustments and an intensified fight against financial crimes:

Historic Anti-Corruption Charge: The charge of former National Service Authority (NSA) officials in a ₵653 million fraud case is a major development. Allegations involve creating thousands of fake personnel profiles and diverting public funds. This action signals a determined push by the Attorney-General to prosecute high-profile financial crimes, which is essential for boosting public trust and safeguarding national funds.

Life-Saving Healthcare Subsidies: The directive to the NHIS to extend a ₵500 subsidy per session for dialysis treatment to private hospitals is a crucial policy shift. Previously, the "free dialysis" program, limited to public facilities, created long waiting times due to limited space. This new, standardized subsidy removes financial barriers for patients using private facilities, ensuring more timely access to care, though patients will cover any cost above the subsidy amount.

TOR's Return: The decision for TOR to restart crude oil refining after a decade of inactivity is economically significant. TOR's closure forced Ghana to spend large amounts of foreign currency on fuel imports, costing the country approximately $10.2 billion in 2024. Restarting operations will help save foreign exchange reserves and reduce reliance on expensive imported fuel.

Investor's Insight: Ghana's Textile Upcycling Boom

The "Waste to Wealth" story is a key opportunity. Ghana receives huge amounts of secondhand clothes, and a lot of it becomes textile waste, harming the environment. Textile upcycling turns this waste into valuable products like new fabrics and even building materials. This is an attractive investment because it uses cost-effective raw material (discarded clothes) for high-demand markets (fashion and construction). Investors profit by funding processing centers, with returns coming from product sales, waste collection contracts, and the sale of carbon credits, turning an environmental problem into a clean, profitable venture.

The trending #WorldCup topic shows the nation's focus has moved from the joy of qualification to strategic preparation. The public debate centers on whether the national team should maintain its core squad or introduce new talent to aim beyond mere participation, aspiring to surpass the 2010 quarter-final success.

Today's Cedi Board highlights a mixed but dynamic economy: the market is seeing welcome relief in key commodity prices, while the government is signaling both an uncompromising stance on corruption and a crucial policy adjustment in healthcare. The return of TOR and the growing upcycling sector point toward a future focused on national capacity building and environmentally smart economic growth.

Follow us daily for the most concise, clear, and critical updates on Ghana's economic pulse.

Comments